Fortune’s Formula book : maximise wealth with the Kelly Formula

Fortune’s Formula by William Poundstone covers the development of the Kelly formula, which can be used to determine how much (if any) of your portfolio to invest in any given stock. In this article, I will explain:

Fortune’s Formula: what is the Kelly formula?

How can you apply the Kelly Formula to stock investing?

What if I overestimate the odds of success?

Fortunes Formula: what is the Kelly Formula?

The Kelly Formula, developed by John R. Kelly in 1954, describes how to determine how much of your money should be deployed into any bet or investment opportunity:

in order to maximise your wealth growth over time, and never lose everything.

Kelly Formula = edge/odds

Edge is the net gain weighted by the

probability of each potential outcome. For example: if the stock currently trades at $10,

and you estimate that there are three outcomes:

1. 70% chance stock goes up 20% to $12

2. 25% chance stock stays at the same level of $10

3. 5% chance stock goes to $0

Edge is (0.7*$2) + (0.25*$0) – (0.05*-$10) = $0.9

The odds are what you win, if you win: or $2. Therefore, the Kelly Formula of edge/odds is 0.9/2 = 45%. So according to the Kelly Formula, you should put 45% of your money on this opportunity. If the formula calculates that you don’t have an edge, then it correctly predicts that you should put zero of your money into the investment opportunity. In order to learn more about how to find good investment opportunities, check our our articles on our three investing strategies: net-nets, value and merger arbitrage.

Next, I describe how to apply the Kelly Formula to stock investing.

To get hold of your copy of Fortune’s Formula, please follow the link below to buy on Amazon.

Fortune's Formula

by William Poundstone

How can you apply the Kelly Formula to stock investing?

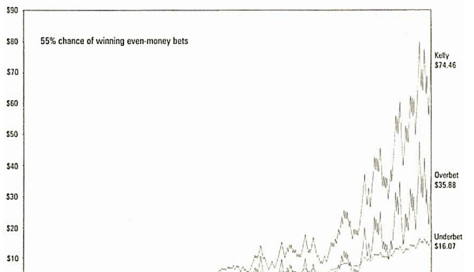

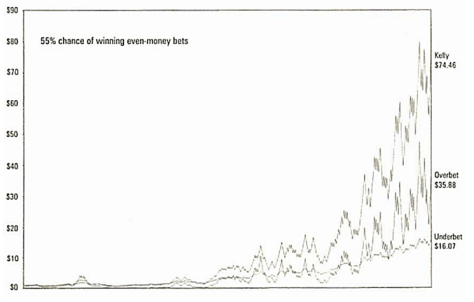

How to reduce volatility: The chart below shows that for a a 55% chance of winning an even-money bet, the Kelly formula will exponentially increase your wealth over time as you repeatedly make this bet. However, if you followed the formula exactly, you will experience significant volatility in your wealth – the Kelly line below has some troughs 50% below the preceeding peak.

This can be emotionally difficult to cope with as you see your wealth halve repeatedly as it grows over time. However, if you underbet the Kelly Formula: i.e. use 0.5x the recommended amount or less: you will experience a lot less volatility – in return for a lower outcome at the end. You can also see in the chart below, the effect of overbetting the Kelly formula: this leads to extreme volatility and a worse outcome at the end and should be avoided.

Superinvestor examples: Furthermore, if you had several good investment opportunities, the Kelly formula may suggest putting a fraction of your total money into each, which together adds up to more than 100% of your total money. Therefore, you can scale this back.

Mohnish Pabrai, in his book, ‘The Dhando Investor,’ puts no more than 10% of his total fund into any one investment opportunity. Warren Buffet went up to 40% for his American Express investment, but this is rare for him.

Concentrated portfolios: The Kelly Formula does show the benefit of a concentrated portfolio: in order to have confidence to accurately estimate the odds of the outcomes for a stock, you should know it very well: so keeping your portfolio between 5-20 stocks is optimal to achieve the best returns. When you see a good opportunity, use Kelly to bet heavily on it to maximise wealth growth over time.

What if I overestimate the odds of success?

Take our example from earlier:

You estimate that there are three outcomes, and the Kelly bet works out to be 45% of your money.

1. 70% chance stock goes up 20% to $12

2. 25% chance stock stays at the same level of $10

3. 5% chance stock goes to $0

However: what if you made a mistake: and there is actually only a 50% chance the stock rises 20% to $12, a 45% chance it stays flat at 10$ and a 5% chance it goes to $0? In this case, the Kelly Formula suggests betting:

($2*0.5+$0*0.45+0.05*-$10)/$2 = 0.25 = 25%. Therefore, if you had bet 1/4 Kelly, or 45%/4 = 11.3% of your money, you would still not be overbetting. Therefore, underbetting the calculated Kelly fraction is a way of building in a margin of safety in case your calculation of the odds of success is over-optimistic.

Would you like to become a better investor? If you would like to learn more about investing, receive regular stock write-ups, and become a better investor, sign up here to receive our free monthly email newsletter. As a welcome gift we will give you our free 5-step investing checklist, and a free Real Worth Stocks sample newsletter!

Name

I accept the terms and conditions

The post Fortune’s Formula book : maximise wealth with the Kelly Formula appeared first on Real Worth Stocks.