Falling stocks – why to avoid losses, and how.

Falling stocks: why avoiding losses is crucial

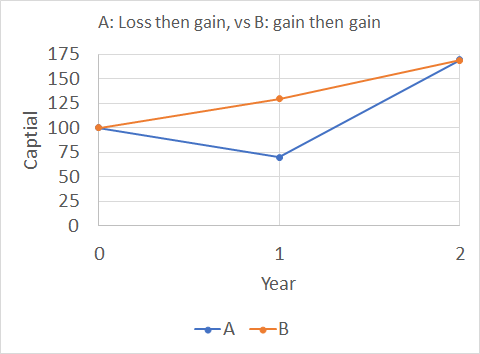

A 30% loss sounds bad, a 30% gain sounds good. But are they equally so? Definitely not, and the graphs below show why. Supposing you had $100, invested it over two years, and gained 30% a year. After one year have $130, and after two years you have $169 – great! However, if you had invested the same money but lost 30% the first year: so now you are starting year 2 with just $70: how much would your investment need to grow by, to get to $169 at the end of year 2? The answer: an eye-watering 142%!

The second graph shows the answer: 142% growth! This is 4.7x times the 30% loss experienced.

‘Rule #1: Never lose money

Rule #2: Never forget rule no 1.’

Warren Buffet

Warren Buffet thinks that avoiding losers is so important, that he stated two rules about it (above). You can read more about his key rules for investing here.

The problem with needing 142% gains to get to the same position, after 2 years, as if you had just had 30% returns for 2 years, is that to have a chance of doing this would require taking a lot of risk. This means that actually getting this outcome of 142% growth – is very unlikely. If that were attempted by increasing risk, the most likely scenario is further losses.

The way the mathematics works, is that the more you lose in year 1, the bigger the gain needs to be as a multiple of this loss to get to the same point as if you just had two gains. Actually, you have a mountain to climb, which is is illustrated below in a graph I called: ‘The Loss Mountain.’ It is scaled so that the axes are about on the same scale.

So as investors, we must avoid losses – but in any investment, there is the risk of loss. So the question then becomes: how can you as an investor, stack the odds in your favour so that the chances of making a loss are so much less than the chances of a gain, that this overcomes the effect of the loss mountain above?

For example: if you had a 90% probability of making a 20% gain and a 10% probability of making a 20% loss in any one year, your odds would be 9:1 in favour of making a 20% gain in any one year. If you invested in 10 stocks with those odds, after 2 years you would be likely to have a 33.4% gain, or 16% compound gain.

However, if you had just a 30% probability of making a 20% loss, and a 70% chance of making a 20% gain, after two years you would have made just 15%, or 7% compound gain.

Falling stocks: how to avoid losses

Here’s two ways to avoid making mistakes that lead to investment losses – learn from others:

‘Only a fool learns from his own mistakes. The wise man learns from the mistakes of others.’

OTTO VAN BISMARCK

or learn from your own mistakes:

‘I like people admitting that they were complete stupid horses’ asses. I know I’ll perform better if I rub my nose in my mistakes. This is a wonderful trick to learn.’

CHARLIE MUNGER

I particularly like Charlie’s take on this, because he is saying that publicly shaming yourself, is the best way to kill your ego, and sear into your memory your mistake so you will never do it again (or be less likely to repeat it!). Therefore, I am going to write about a mistake or mistakes I made in investing, in my next post.

Takeaway:

To be a better investor, avoid losing money

To avoid losing money, admit your mistakes publicly

To read more about Real Worth Stocks investing strategies, which we follow to help avoid investing losses, check out our articles on merger-arbitrage investing, and net net stock investing.

The post Falling stocks – why to avoid losses, and how. appeared first on Real Worth Stocks.